Testing Statistical Hypotheses

Univariate Statistics and Methodology using R

Psychology, PPLS

University of Edinburgh

Probability and the Normal Curve

More about Height

imagine that we know all about the heights of a population

mean height (\(\bar{x}\)) is 170; standard deviation (\(\sigma\)) is 12

How Unusual is Casper?

in his socks, Casper is 198 cm tall

how likely would we be to find someone Casper’s height in our population?

How Unusual is Casper (Take 2)?

in his socks, Casper is 198 cm tall

how likely would we be to find someone Casper’s height or more in our population?

the area is 0.0098

so the probability of finding someone in our population of Casper’s height or greater is .0098 (or, \(p=.0098\) )

Area under the Curve

Tailedness

- we kind of knew that Casper was tall

- it made sense to ask what the likelihood of finding someone 198 cm or greater was

- this is called a one-tailed hypothesis (we’re not expecting Casper to be well below average height!)

Tailedness (2)

- often our hypothesis might be vaguer

- we expect Casper to be “different”, but we’re not sure how

- we can capture this using a two-tailed hypothesis

So: Is Casper Special?

how surprised should we be that Casper is 198 cm tall?

given the population he’s in, the probability that he’s 28cm or more taller than the mean of 170 is .0098

- NB., this is according to a one-tailed hypothesis

- a more accurate way of saying this is that .0098 is the probability of selecting him (or someone even taller than him) from our population at random

A Judgement Call

- if a 1% probability is small enough

- if a 1% chance doesn’t impress us much

- in either case, we have nothing (mathematical) to say about the reasons for Casper’s height

Group Means

Investment Strategies

The Playmo Investors’ Circle have been pursuing a special investment strategy over the past year. By no means everyone has made a profit. Is the strategy worth advertising to others?

About the Investments

there are 12 investors

the mean profit is £11.98

the standard deviation is £20.14

the standard error is \(\sigma/\sqrt{12}\) which is 5.8148

- we are interested in the probability of 12 people (from the same population) making at least a mean £11.98 profit

Using Standard Error

together with the mean, the standard error describes a normal distribution

“likely distribution of means for other samples of 12”

Using Standard Error (2)

last time, our null hypothesis (“most likely outcome”) was “Casper is of average height”

this time, our null hypothesis is “there was no profit”

easiest way to operationalize this:

- “the average profit was zero”

so redraw the normal curve with the same standard error and a mean of zero

Using Standard Error (3)

the curve we would obtain if nothing of interest had happened in a world which was as variable as the one we measured

Using Standard Error (4)

The Standardized Version

- last week we talked about the standard normal curve

- mean = 0; standard deviation = 1

\[z_i = \frac{x_i - \bar{x}}{\sigma}\]

our investors’ curve is very easy to transform

subtract 0; divide by standard error

The Standardized Version (2)

mean(profit)/se= 2.06- “number of standard errors from zero”

you can take any mean, and any standard deviation, and produce “number of standard errors from zero”

\(z=\bar{x}/\sigma\)

The Standard Normal Curve

\(z=\bar{x}/\sigma\)

the point of the calculation is to compare to the standard normal curve

made “looking up probability” easier in the days of printed tables

usual practice is to refer to standardised statistics

- the name chosen for them comes from the relevant distribution

\(z\) is assessed using the normal distribution

Which Means…

- for \(z=2.06\), \(p=.0197\)

if you picked 12 people at random from the population of investors we sampled from, and the population were making no profit overall, there would be, roughly, a 2% chance that the 12 would have an average profit of £11.98 or more

is 2% low enough for you to believe that our investors’ mean profit wasn’t due to chance?

again, it’s a judgement call

but before we make that judgement…

The \(t\)-test

A Small Confession

part 2 wasn’t entirely true

all of the principles are correct, but for smaller \(n\) the normal curve isn’t the best estimate

for that we use the \(t\) distribution

The \(t\) Distribution

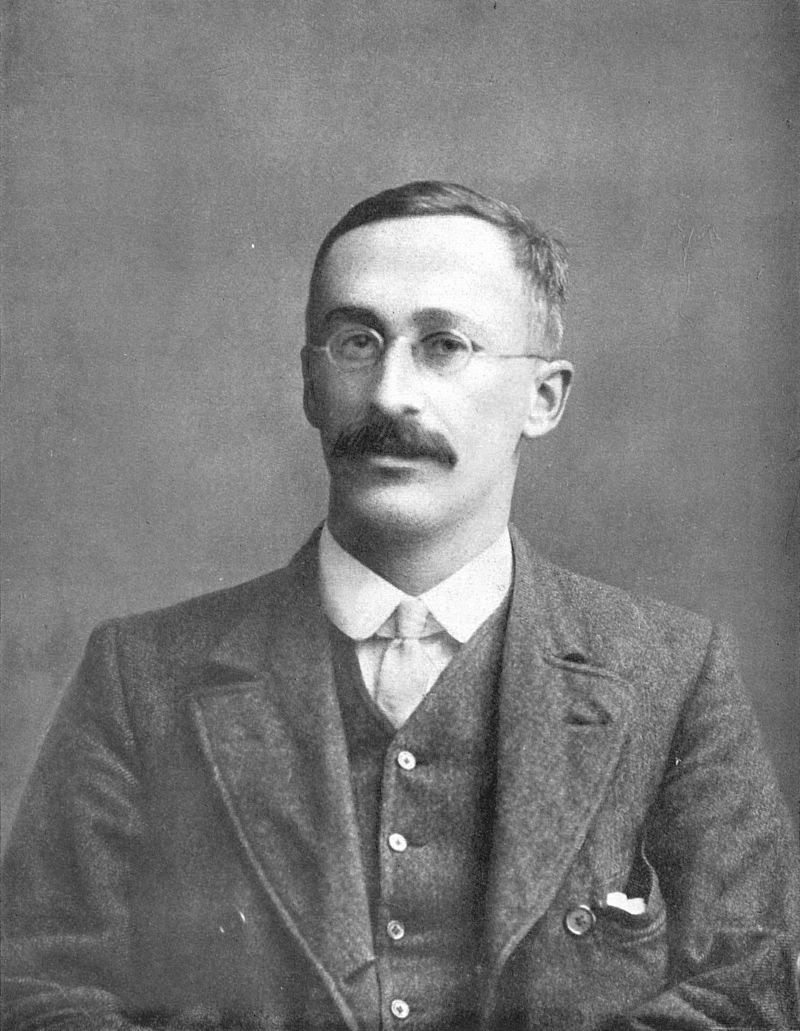

“A. Student”, or William Sealy Gossett

- the shape changes according to degrees of freedom, hence \(t(11)\)

The \(t\) Distribution

conceptually, the \(t\) distribution increases uncertainty when the sample is small

- the probability of more extreme values is slightly higher

exact shape of distribution depends on sample size

the degrees of freedom are inherited from the standard error

\[ \textrm{se} = \frac{\sigma}{\sqrt{n}} = \frac{\sqrt{\frac{\sum{(\bar{x}-x)^2}}{\color{red}{n-1}}}}{\sqrt{n}} \]

Using the \(t\) Distribution

in part 2,mean profit was £11.98; standard error was 5.8148

we used the formula \(z=\bar{x}/\sigma\) to calculate \(z\), and the standard normal curve to calculate probability

the formula for \(t\) is the same as the formula for \(z\)

what differs is the distribution we are using to calculate probability

we need to know the degrees of freedom (to get the right \(t\)-curve)

so \(t(\textrm{df}) = \bar{x}/\sigma\)

\(t\) and Probability

for 12 people who made a mean profit of £11.98 with an se of 5.8148

\(t(11) = 11.98/5.8148 = 2.0603\)

instead of

pnorm()we usept()for the \(t\) distributionpt()requires the degrees of freedom

the chance that 12 random investors from our population show a mean profit of £11.98 or more is actually around 3%

Did We Have to Do All That Work?

one-sample \(t\)-test

compares a single sample against a hypothetical mean (

mu)- usually zero

Types of Hypothesis

note the use of

alternative = "greater"we’ve talked about the null hypothesis (also H0)

- there is no profit (mean profit = 0)

the alternative hypothesis (H1, experimental hypothesis) is the hypothesis we’re interested in

- here, that the profit is reliably £11.98 or more (one-tailed hypothesis)

could also use

alternative = "less"oralternative = "two.sided"

Experiments Involve Differences

- but of course “profit” is a difference between paired samples

| before | after | profit |

|---|---|---|

| £362.68 | £378.44 | £15.76 |

| £370.28 | £369.45 | −£0.83 |

| £165.38 | £162.31 | −£3.07 |

| £633.64 | £660.07 | £26.43 |

| £579.65 | £569.65 | −£10.00 |

| £314.22 | £325.31 | £11.09 |

Equivalent \(t\)-tests

Putting it Together

- for \(t(11)=2.0603\), \(p=.0319\)

if you picked 12 people at random from the population of investors we sampled from, and the population were making no profit overall, there would be, roughly, a 3% chance that the 12 would have an average profit of £11.98 or more

is 3% low enough for you to believe that the mean profit wasn’t due to chance?

perhaps we’d better face up to this question!

Setting the Alpha Level

the \(\alpha\) level is a criterion for \(p\)

if \(p\) is lower than the \(\alpha\) level

we can (decide to) reject H0

we can (implicitly) accept H1

what we set \(\alpha\) to is a matter of convention

typically, in Psychology, \(\color{red}{\alpha}\) is set to .05

- important to set before any statistical analysis

\(p < .05\)

the \(p\)-value is the probability of finding our results under H0, the null hypothesis

H0 is essentially “💩 happens”

\(\alpha\) is the maximum level of \(p\) at which we are prepared to conclude that H0 is false (and argue for H1)

there is a 5% probability of falsely rejecting H0

wrongly rejecting H0 (false positive) is a type 1 error

wrongly accepting H0 (false negative) is a type 2 error